Pawn shops have been around for centuries, offering a quick and easy way to secure cash in exchange for valuable items. Gold buyers Melbourne are often a significant part of the pawn shop industry, especially when it comes to assessing the value of gold jewelry and other precious items. In this article, we’ll explore how pawn shops work, the role of gold buyers Melbourne in the process, and how you can benefit from using pawn shops for quick cash.

Table of Contents

What Are Pawn Shops and How Do They Operate?

Pawn shops are businesses that offer secured loans in exchange for collateral, such as gold jewelry, watches, electronics, and other valuables. When you need money quickly, you can bring an item of value to the pawn shop, and the shop will offer you a loan based on the value of the item. The pawn shop holds onto the item until the loan is repaid. If you don’t repay the loan within the agreed time frame, the pawn shop keeps the item, which is why it’s essential to understand how pawn shops work before using them. Gold buyers Melbourne are often involved in this process, especially when gold jewelry or other precious metals are used as collateral.

How Do Pawn Shops Assess the Value of Items?

Pawn shops assess the value of items based on their worth in the current market. The process typically involves evaluating the item’s condition, market demand, and resale value. When it comes to valuable items like gold jewelry, gold buyers Melbourne play a key role. They will evaluate the purity and weight of the gold, as well as any unique features, such as gemstones or intricate designs. Gold is often priced based on its weight and karat, which reflects its purity. Once the value is determined, the pawn shop will offer a loan that is a percentage of the item’s appraised value, usually around 50-75%.

The Role of Gold Buyers Melbourne in Pawn Shops

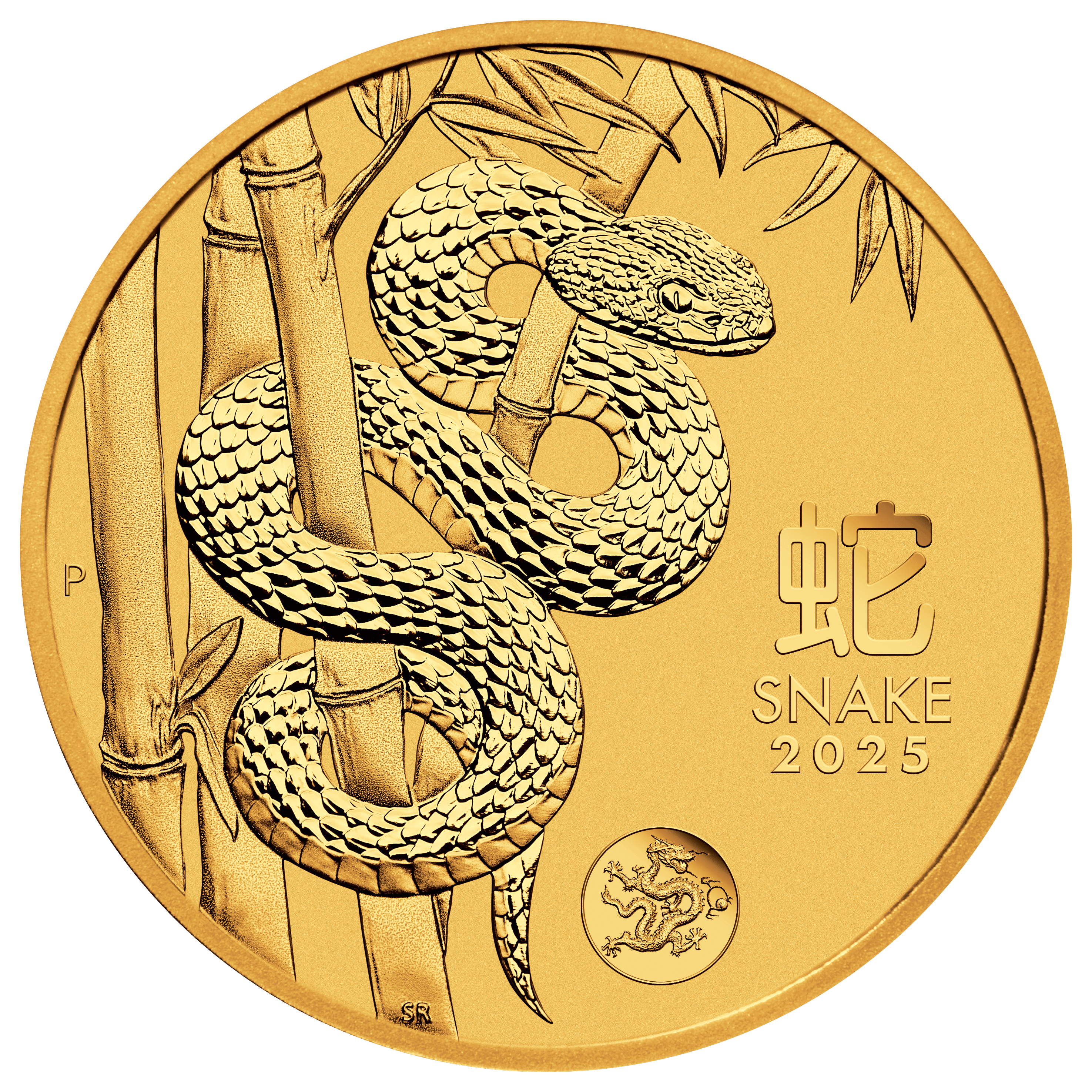

Gold buyers Melbourne are essential to the pawn shop process, especially when it comes to evaluating gold items like jewelry, coins, and bullion. Gold buyers have the expertise to accurately appraise the gold content of an item, ensuring that both the customer and the pawn shop get a fair deal. If you bring gold jewelry to a pawn shop, the gold buyers Melbourne will weigh and test the gold’s purity, typically using a process like acid testing or electronic gold testers. This ensures that the pawn shop is offering you a fair loan based on the actual value of the gold. Their role is vital in the transparency and accuracy of the pawn shop’s offer.

The Loan Process at Pawn Shops

Once the value of the item is determined, the pawn shop will offer you a loan. The loan amount is typically a fraction of the item’s value, as the pawn shop needs to cover the risk of holding onto the item in case the loan isn’t repaid. In the case of gold jewelry, gold buyers Melbourne ensure that the gold’s purity and weight are accurately measured, which affects the loan offer. If you agree to the terms, the pawn shop will provide you with cash and hold onto your item as collateral. The loan will typically come with a set repayment period, often 30 days to a few months, and will include interest and fees.

Repaying the Loan: What Happens Next?

When you take out a loan at a pawn shop, you are given the option to repay the loan within the agreed-upon period. If you repay the loan and any interest or fees in full, you can reclaim your item from the pawn shop. Gold buyers Melbourne can also help you ensure that the item’s value is preserved throughout the loan period, so when you pay it back, you get back exactly what you left behind. If you don’t repay the loan within the specified time frame, the pawn shop has the right to keep your item and sell it to recoup the loan amount. This is where the process differs from selling an item outright, as you can still retrieve your valuable items after repaying the loan.

What Happens If You Can’t Repay the Loan?

If you fail to repay the loan in the agreed-upon time, the pawn shop has the legal right to keep your item. This is a significant difference between pawning and selling an item outright. Gold buyers Melbourne will often assess gold items thoroughly before offering a loan, ensuring that they are confident in their resale value. If you are unable to repay the loan, the pawn shop will keep your gold items and may sell them for profit. While this can be a risk, it’s important to only borrow what you can afford to repay to avoid losing valuable items, especially those with sentimental or long-term value.

The Advantages of Using Pawn Shops for Quick Loans

One of the primary advantages of using pawn shops is the speed and convenience of getting cash quickly. Unlike traditional banks or other financial institutions, pawn shops don’t require credit checks or lengthy approval processes. As long as you have an item of value, such as gold jewelry, you can often walk away with cash within minutes. This makes pawn shops an excellent option for individuals who need quick funds but don’t want to undergo the hassle of a credit application. Gold buyers Melbourne are particularly useful when evaluating the value of gold items, ensuring that you receive a fair offer for your gold collateral.

Risks of Using Pawn Shops for Loans

While pawn shops offer quick access to cash, there are risks involved. The main risk is that if you fail to repay the loan, you will lose your item. For those who have valuable or sentimental items, this can be a significant concern. Additionally, pawn shops often charge high interest rates and fees, making it more expensive to repay the loan. Gold buyers Melbourne can help ensure that you’re receiving a fair loan offer based on your gold’s actual value, but it’s essential to weigh the costs and benefits of using a pawn shop before proceeding.

How to Maximize the Value of Your Gold Items in Pawn Shops

If you decide to use a pawn shop, there are ways to ensure you get the best possible loan offer. First, bring in well-maintained items that are clean and in good condition. Gold buyers Melbourne can provide accurate appraisals, so it’s important to understand the value of your items before visiting the pawn shop. Knowing the current market value of gold can also help you gauge whether you’re being offered a fair loan. It’s also wise to shop around and compare offers from multiple pawn shops or gold buyers to ensure you’re getting the best deal possible.

Conclusion: Using Pawn Shops and Gold Buyers in Melbourne for Quick Loans

In conclusion, pawn shops provide an accessible and fast way to secure cash, especially when you need funds urgently. Gold buyers Melbourne play a key role in ensuring that the process is transparent and fair when gold items are used as collateral. Whether you’re pawning gold jewelry, coins, or other valuables, working with professional gold buyers ensures that you receive an accurate appraisal and fair loan offer. By understanding how pawn shops work, you can make informed decisions about securing loans and leveraging the value of your gold.